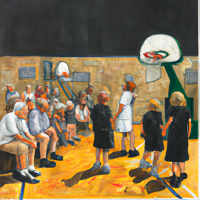

10 Ways to Help Ensure Your Assets Transfer Smoothly to Your Heirs (And So That They Don’t Squander Your Money After You’re Gone)

Posted by One Bridge Wealth Management on Tue, 03/19/2024 - 14:25

A study referenced in Forbes shows rich Boomers (Ages 59-77) are stressed about how they’ll hand their fortunes down to their kids.

Here are 10 ways to help ensure your assets transfer smoothly to your heirs – and so that they don’t squander your money after you’re gone.

Maximizing Philanthropy and Minimizing Taxes: The Power of Qualified Charitable Distributions (QCDs) from IRAs

Posted by One Bridge Wealth Management on Wed, 03/13/2024 - 13:56

In the realm of financial planning, one powerful tool often overlooked is the Qualified Charitable Distribution (QCD) from Individual Retirement Accounts (IRAs). This strategy allows individuals to support charitable causes while minimizing tax liabilities, providing both philanthropic fulfillment and financial benefits. In this article, we'll explore the ins and outs of QCDs and how they can be leveraged effectively for charitable giving and tax planning.

Supporting Women as Investors, Here at One Bridge

Posted by One Bridge Wealth Management on Fri, 03/08/2024 - 14:14

Historically, investing has been perceived as a predominantly male domain, with women often underrepresented in the investment landscape. Women tend to have longer lifespans. In today’s world, many women choose to remain single throughout their lives or they become widowed, while others are married and in charge of the finances. The reality is that women today are more engaged in personal finance and investing than in previous generations. We're here to provide assistance in this regard. Investing is a crucial component of financial planning, providing individuals with the opportunity to grow wealth and secure their financial futures. At One Bridge Wealth Management, we recognize the importance of empowering women as investors and helping them navigate the world of investing with confidence and ease.

Harnessing the Power of Intentionally Defective Grantor Trusts (IDGTs) with One Bridge Wealth Management

Posted by One Bridge Wealth Management on Thu, 03/07/2024 - 14:09

Estate planning is a crucial aspect of financial management, ensuring that individuals can effectively transfer wealth to their loved ones while minimizing tax liabilities. Among the various estate planning strategies available, Intentionally Defective Grantor Trusts (IDGTs) stand out as a powerful tool for achieving these objectives. In this article, we'll explore the concept of IDGTs and how they can be utilized effectively with the help of One Bridge Wealth Management, St. Louis Financial Advisors.

Enhancing Returns by Reducing Taxes: The Art of Tax-Efficient Wealth Management

Posted by One Bridge Wealth Management on Wed, 02/28/2024 - 12:12

In the world of wealth management, one of the key objectives for investors is to maximize returns while minimizing tax liabilities. Tax-efficient wealth management is a strategy that focuses on achieving this delicate balance, allowing individuals to grow their wealth effectively while keeping a close eye on their tax obligations.

0% Tax Brackets, Tax Changes and Planning Opportunities: Keep Your Wallet Full Even When Uncle Sam Takes His Share

Posted by John Wahl on Tue, 02/13/2024 - 13:27

In the ever-evolving world of politics and finance, staying abreast of tax law changes is crucial for individuals seeking to minimize their tax burden and maximize their financial well-being. Let’s address:

- The 0% ordinary income “tax bracket”

- The 0% capital gains and qualified dividends tax bracket

- The TCJA tax rate sunset in 2026

The Evolution of Fed Announcements: From Whispers to Microphones; From Jekyll Island to 60 Minutes

Posted by One Bridge Wealth Management on Tue, 02/06/2024 - 11:08

In understanding the evolution of the Federal Reserve and its communication practices, it's essential to recognize the historic significance of Jekyll Island. In November 1910, a secret meeting of just six men - influential bankers and financiers - took place on Jekyll Island, Georgia, laying the groundwork for what would eventually become the Federal Reserve System. The meeting and its purpose were closely guarded secrets, and the six men did not admit that the meeting occurred until the 1930s.

The Pitfalls of Target Date Funds, Robo-Advisors, and DIY-ers

Posted by One Bridge Wealth Management on Wed, 10/18/2023 - 12:15

If you're an investor with a substantial portfolio, you may be wondering if target date funds or robo-advisors are right for you. While alluring in their simplicity and low costs, both options have considerable downsides for high-net-worth individuals. In this post, we explain the issues you should know and why personalized financial planning is ultimately essential.

Should I Roll Over My $1M 401k in Retirement?

Posted by One Bridge Wealth Management on Thu, 10/12/2023 - 11:23

With a 401k balance exceeding $1 million, retirees in St. Louis (and across the country) face an important decision - should they roll over funds into an IRA or leave it with their employer? This guide examines the pros and cons of both options.

Financial Planning for $750k+ Portfolios in Retirement in St. Louis, MO

Posted by One Bridge Wealth Management on Fri, 10/06/2023 - 13:30

Professional guidance for retirees in St. Louis, MO with substantial portfolios over $750k. Discover popular and unique planning strategies to generate retirement income, reduce taxes, and create a legacy.