Schedule Your Complimentary Strategy Session Today

What will the market do in 2023?

While thinking and talking about this can be fun and entertaining, we should remember no one has a crystal ball. No one. Too many of us are fooled by randomness. Therefore, instead of planning for one outcome or one prediction, we need to plan for a range of outcomes. "He who lives by the crystal ball will eat shattered glass." -- Ray Dalio

What do those outcomes look like?

A few interesting predicted-outcomes are as follows.

One is that in or before Q1 2023 we will see some sort of adverse credit event. This typically occurs when the Fed raises rates like it has been. Something breaks. This credit event would probably occur in an industry or to a business or institution with contagion risk. The next viewpoint forks in either direction:

- Bad news is good news and the Fed reverses policy. If that happens then markets rise starting in Q2/Q3 2023.

- Or bad news is bad news. The Fed either gets its policy response wrong or its response doesn’t matter to the market. The market goes south regardless.

Another contrarian predicted-outcome is that inflation is here to stay. The Bank of Japan increased its 10-year yield and that could mean that it is taking inflation seriously. If the Bank of Japan is taking inflation seriously in Japan, then inflation could be here longer than expected and the Fed will not pause or reverse course in 2023 as expected. Then, we are in for more hawkishness and therefore a worse market... It’s an interesting possibility.

It's safe to say the consensus viewpoint is that we have a mild recession in 2023. If that happens, what will the market do? Your guess is as good as mine, but I can say this: the market tends to lead the economy. In other words, the market moves in the same direction as the economy but before the economy does so. If that holds true, then perhaps we see a bottom in Q1! Or perhaps we’re seeing it now. Perhaps the Santa Claus Rally will occur this year… wouldn’t that be nice!

Ken Fisher recently pointed out that "CEOs of almost every big bank have openly trashed the US economy and predicted a recession. But recessions always bring savagely rising default rates on their loans, pummeling earnings. If these bankers were truly fearful of defaults, these bankers presumably would have already scuttled their lending. They haven’t. November’s US loan growth hit 11.8% year-over-year, accelerating from year-end 2021’s 4.0%, showing monthly growth that’s notably inconsistent with looming recession. Ditto for global loan growth, which has grown every month since March. Watch what banks do, not what they say. What they say is sentiment. What they do is reality."

Also, "Like 1966, 2022 was a midterm election year. Midterms create stock market rocket fuel — averaging 18%-plus returns during the third years of US presidents’ terms. They have been stronger still, averaging 28%, when the second year was negative, like 2022 and 1966 were. Stocks surged 24% in 1967."(4)

So, again, plan for a range of outcomes.

Look how wrong institutions and analysts have been…

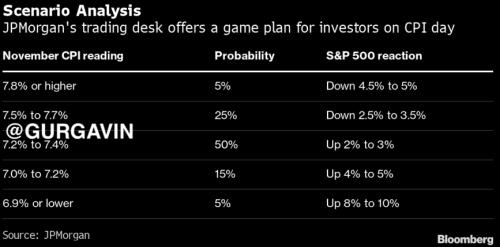

JPMorgan recently put out predictions of the SP500 response to various November CPI prints. They are reprinted here (1):

What actually happened? CPI came in at 7.1%. JPMorgan predicted a 15% chance of that happening… and it happened. It then predicted the SP500 would rise 4 to 5%. What actually happened? It is down around 4% as of this writing (12-21-22).

Even if you could predict what the inflation print would come in at (which you can't), you can’t accurately or consistently predict how the market will react. So, again, plan for a range of outcomes.

Just look at the forecasts for SP500 in 2023 and what the forecasts were for 2022. (2)

Note, as of this writing on 12-21-22, the SP500 closed at 3,878.

|

2023 SP500 Forecasts |

2022 SP500 Forecasts |

|

Deutsche Bank 4500 |

Oppenheimer 5330 |

|

Oppenheimer 4400 |

BMO 5300 |

|

BMO 4300 |

DB 5250 |

|

JPMorgan 4200 |

CS 5200 |

|

Jefferies 4200 |

GS 5100 |

|

Wells 4200 |

JPM 5050 |

|

Evercore 4150 |

RBC 5050 |

|

RBC 4100 |

CITI 4900 |

|

Credit Suisse 4050 |

UBS 4850 |

|

Goldman Sachs 4000 |

CANTOR 4800 |

|

HSBC 4000 |

BARCLAYS 4800 |

|

Citi 4000 |

WELLS 4715 |

|

BofA 4000 |

B OF A 4600 |

|

UBS 3900 |

MS 4400 |

|

Morgan Stanley 3900 |

|

|

Barclays 3725 |

|

|

SocGen 3650 |

|

|

BNP Paribas 3400 |

|

What are some other things going on?

There are signs of lower US inflation rates to come and this would likely be good for the market. (3)

- Gas prices are down 37% from June peak.

- Used car prices down 19% from peak.

- Global freight rates down 81% from 2021 peak.

- Fertilizer prices down 45% from March peak.

- Rents down in Sep, Oct, & Nov.

- Home Prices down over 10% from June peak

What about China?

According to Felix Zulauf, China is in a severe recession – more severe than it was in the Great Recession. The ripple effects touch most parts of the globe.

Also according to Zulauf, the US made a huge mistake in freezing US assets of other countries such as Russia as a policy response. China and dictatorial countries will now try to wean themselves off US treasuries because they don’t want to be blackmailed if they do something the US doesn’t approve of. China is trying to create a new type of currency to settle transactions. He sees foreign central banks holding more commodities, raw minerals, and gold in its reserves than US treasuries moving forward.

So, what does this mean for you? You guessed it. Plan for a range of outcomes.

Also, check out our CIO Brad McMillan’s outlook for 2023… In summary: It Depends on the Fed. Our outlook for 2023 remains uncertain and will hinge on whether the Fed is able to rein in inflation while keeping us out of recession. But because the labor market continues to show strength, lending support to the consumer sector—the largest part of the economy—we are cautiously optimistic that the economy and markets will move in a positive direction in the new year, though there may be some bumps along the way.

Schedule Your Complimentary Strategy Session Today

- https://twitter.com/gurgavin/status/1602399926515793920/photo/1

- https://twitter.com/FerroTV/status/1605508606547435520?s=20&t=tf7mpkN2eC...

- https://twitter.com/charliebilello/status/1603819402734059520?s=20&t=tf7mpkN2eCfKLXQ1oBvyLA

- https://nypost.com/2022/12/25/why-2023-will-be-like-1967s-summer-of-love...