Schedule Your Complimentary Strategy Session Today

Rising Yields, The Economy, and The Stock Market

Longer term bond yields are rising. Why? And this hurts stocks, why? But the economy is strong? Read on.

- Longer term bond yields are rising. Why? And this hurts stocks. Why?

- Recent jobs data on the economy is strong. This seems to indicate that the economy is handling just fine the higher short term interest rate set by the Fed. (Remember, longer term bond yields are set by the market vs. short term rates that are set by the Fed.) The recent (JOLTS) jobs report shows a strong/tight labor market, meaning there are a very high and increasing number of job openings. To the tune of 9.6 million job openings in August. Good news, right?

- This strong economic data spooks the market because it could signal to the Fed that the economy is still running too hot. So, longer term yields are rising because, while we are likely close to the end of the Fed’s hiking cycle, markets (traders/investors/institutions) are realizing that the Fed is not likely to cut rates anytime soon. Rates are likely to stay higher for longer.

- Other reasons longer term yields are rising are that the US is issuing more and more bonds to finance the surge in the budget deficit. That is partly what led to Fitch to cut the government's AAA rating a month ago. So, more bonds being issued and supposed investor concern on the credit rating creates more supply than demand for bonds. When supply is greater than demand, prices drop. When bond prices drop, yields rise.

- Why does this hurt stocks in the short term?

- Higher rates mean higher borrowing costs for businesses. The higher borrowing costs (interest expense) cut into their profits, which make those company stocks less attractive. Additionally, in anticipation of this, their stocks are sold.

- As bond yields increase, they become more attractive to investors who may shift money away from stocks and toward bonds and T Bills, causing stock prices to decrease. And again, in anticipation of this, their stocks are sold.

It's important to note that the relationship between bond rates and stock prices can be complex and influenced by various factors, including the magnitude and speed of rate increases, overall economic conditions, and investor sentiment. While higher long-term bond rates may put downward pressure on stock prices in the short term, the longer-term impact can vary depending on how other economic and financial factors evolve. Investors should consider a holistic view of the market and their investment goals when making decisions in response to changes in interest rates.

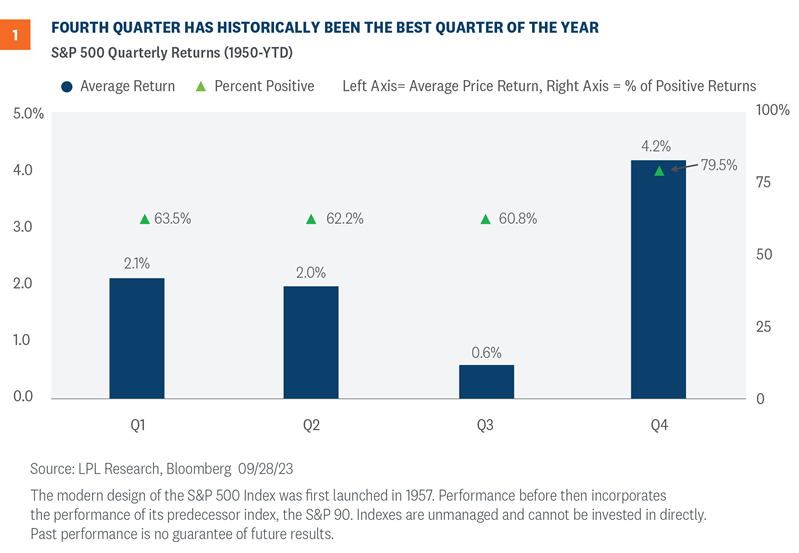

To leave you with a positive note: We are leaving, historically, the worst month of the year for the stock market: September. And we are entering, historically, the best time of the year for the stock market: Q4.

Schedule Your Complimentary Strategy Session Today

https://www.nytimes.com/2023/10/03/business/economy/jolts-job-openings-layoffs.html