Schedule a Strategy Session Today

A Journey Through Time: The History of Income Tax in the United States

See below for how this knowledge can help improve your investment portfolios.

Income tax has been a cornerstone of fiscal policy in the United States for over a century, shaping the nation's economic landscape and social structure. Its history is a tale of political maneuvering, economic necessity, and societal transformation. From its inception to the present day, the evolution of income tax rates reflects shifting priorities, ideologies, and economic realities.

The roots of income taxation in the United States can be traced back to the Civil War era. In 1861, to finance the Union's war effort, Congress passed the Revenue Act, which levied a 3% tax on incomes over $800. This tax was repealed after the war, but the idea of taxing income had taken root.

It wasn't until the early 20th century, however, that income tax became a permanent fixture of the U.S. tax system. The Revenue Act of 1908 was signed into law by Teddy Roosevelt, which levied the highest income tax rate of 1% on net incomes above $4,000 for individuals and above $5,000 for married couples (equivalent to approximately $113k and $141k respectively).

In 1913, the 16th Amendment to the Constitution was ratified, granting Congress the power to levy taxes on income without apportionment among the states. That same year, the Revenue Act of 1913 established a graduated income tax system with seven tax brackets. The highest bracket was 7%. The other brackets were 1,2,3,4,5 and 6% - pretty simple! The 7% tax was levied on incomes over $500,000 (equivalent to over $12 million in today's dollars).

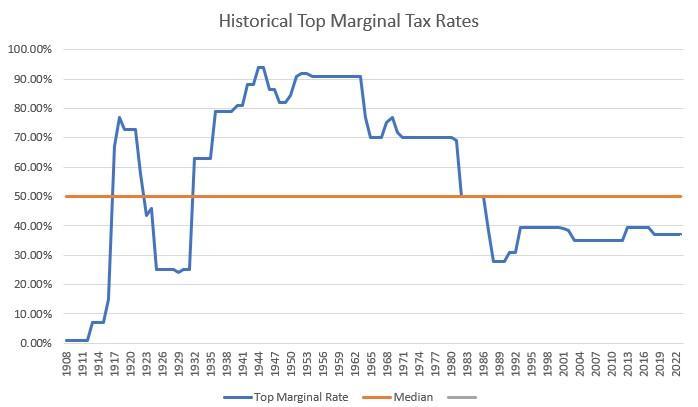

Throughout the following decades, income tax rates fluctuated in response to economic conditions and wartime needs. During World War I, rates soared to finance the war effort, with the top marginal rate reaching a staggering 77% on incomes over $1 million. Following the war, rates gradually declined but remained relatively high compared to pre-war levels.

The Great Depression ushered in a new era of taxation. In 1932, against the backdrop of economic turmoil, Congress passed the Revenue Act of 1932, which raised income tax rates across the board. The highest marginal rate peaked at 63% on incomes over $1 million. These elevated rates persisted throughout the 1930s as the government sought to generate revenue to fund relief programs and stimulate economic recovery.

The onset of World War II once again transformed the tax landscape. To finance the war effort, Congress enacted the Revenue Act of 1942, which significantly raised income tax rates. The top marginal rate skyrocketed to 94% on incomes over $200,000 (equivalent to approximately $3 million today), the highest in U.S. history. These exorbitant rates remained in place throughout the war years, ensuring a steady stream of revenue to fund military operations.

In the post-war era, income tax rates gradually declined but remained relatively high compared to pre-war levels. The 1950s and 1960s saw marginal rates fluctuating between 70% and 90% for the highest income earners. However, the tax landscape began to shift in the 1980s with the advent of supply-side economics and the Reagan administration's push for tax cuts. The Tax Reform Act of 1986 lowered the top marginal rate to 28%, marking a significant departure from the high-tax policies of previous decades.

Since the 1980s, income tax rates have continued to fluctuate in response to changing economic conditions and political priorities. While the top marginal rate has never again reached the heights of the mid-20th century, it has remained a topic of debate and contention in American politics.

Believe it or not, income tax rates are at some of their lowest going back to the implementation of the income tax in 1908. Knowing this can help give you a framework to think about where tax rates are going over the next 10-20-30 years. We have historically low tax rates and historically high national debt. What’s going to happen? Is the government more likely to cut spending or increase taxes? If you think tax rates are more likely to rise, then perhaps you should take advantage of these lower rates now via Roth conversions and taking more income now.

Schedule a Strategy Session Today

https://www.taxpolicycenter.org/statistics/historical-highest-marginal-income-tax-rates