Schedule Your Complimentary Strategy Session Today

A brief history of inflation and the stock market

Inflation is no longer knocking on our door. It has now entered our home, walked straight into the kitchen uninvited, opened the frig and cracked open a beer. (Monetary policy, fiscal policy, and the Pandemic kindly opened the front door BTW.) You might be asking, what will happen with inflation and the stock market? What will inflation do to my portfolio?

It can be useful to look to the past. All things are not the same. We (our Fed and our government) have learned from the past. Those lessons affect how we react to today’s inflation. Because we handle it differently now (and for a myriad of other random variables), there will be different outcomes. But it’s interesting to look back regardless.

Here is a summary of some findings on inflation and the stock market:

- The best “real” returns come when inflation is moderate (around 2% to 3%). (5)

- Stocks tend to be more volatile when inflation is elevated. (1)

- Most researchers have found that higher inflation is generally correlated with lower stock prices. (1)

- When inflation is higher, the economy is usually heating up. When it is lower, the economy is usually slowing down. But as we saw in the 1930s (see graph below), a bad economy does not necessarily mean a terrible stock market, although not a great market either. (5)

- Value stocks may perform better in high inflation periods and growth stocks may perform better when inflation is low. (1)

- Blue-chip stocks may perform better than growth stocks in high inflation periods because they might carry less debt. A rise in interest rates (associated with rising inflation) will increase operating costs for a company that depends on debt-fueled growth. (2)

- Banks may perform better during high inflation periods because their profits on loans increase when interest rates rise. (2)

- The more cash or cash equivalents you hold, the worse inflation will punish you. (2)

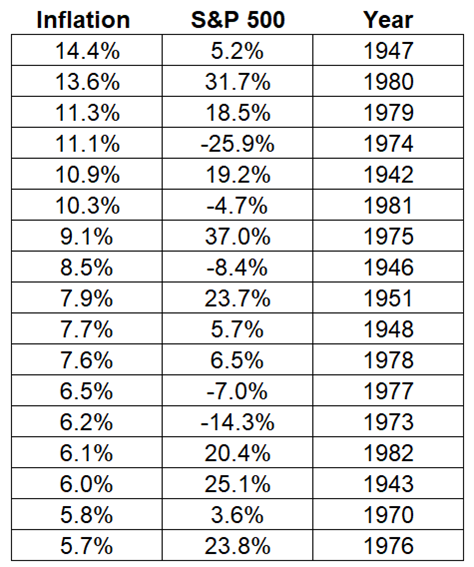

- The table below shows 5.7% inflation rates or higher and the corresponding return of the S&P500 from 1928-2020, courtesy of Ben Carlson. (3)

- When inflation has been 5.7% or higher, the stock market has held up well, although there is no clear pattern. (3)

- The average returns for the S&P 500 in these years were 9.4%. That’s essentially the long-term average over the past 90 plus years. (3)

- Eight out of the 17 years had double-digit returns. Over one-third of the time, returns were more than 20%. (3)

- Keep in mind that those returns were lower on a real basis after accounting for the higher inflation. But the market did not always perform terribly when inflation was high. (3)

- If inflation is higher moving forward, that doesn’t mean the stock market will tank.(3)

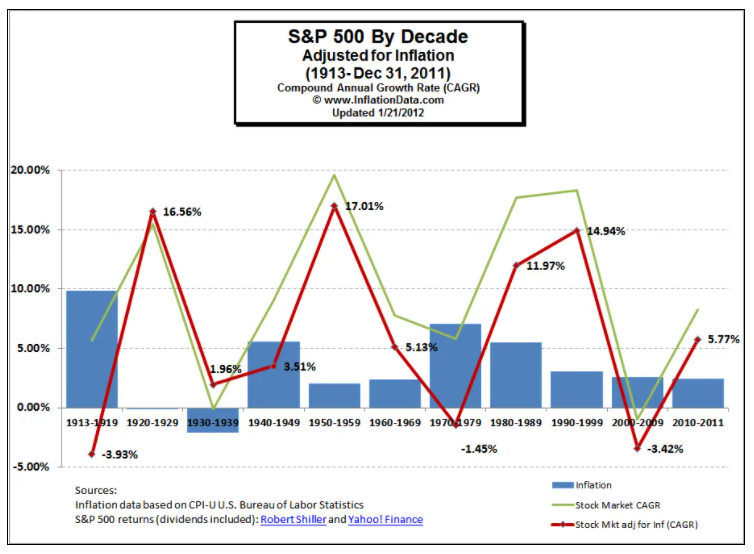

- From the chart below, there doesn’t appear to be a correlation between high stock market returns and high inflation. There might even be an inverse correlation with the stock market doing better during decades with the inflation rate below 3%. The exception is the 1930s when there was outright deflation and the 2000s. (5)

- Three decades out of ten had negative real returns. (5) This is likely due to both government policies and other external forces. Always keep in mind cyclicality.

- To get the true picture, you need to see the actual level of the market returns minus the inflation rate. So, the red line is the real rate of return for each decade. The green line is the market return. And the blue bars represent inflation. (5)

So, what is different today?

Too many things to name them all! Low Unemployment! High earnings! Many people unemployed/low labor participation rate! Post-pandemic trends! They’ll probably reverse some, but not recover fully according to Jim Bianco’s interesting twitter thread.

If you liked this, then you’ll probably enjoy this: A BRIEF, MODERN HISTORY OF SURPRISE FED ANNOUNCEMENTS.

Schedule Your Complimentary Strategy Session Today

While we can’t answer questions you might have, such as, what will inflation do to the market, or what will inflation do to my stocks, we can look back at what has happened in the past.

(1) https://www.investopedia.com/articles/investing/052913/inflations-impact-stock-returns.asp

(2) https://www.thebalance.com/what-stock-investors-should-know-about-inflation-3141218

(3) https://awealthofcommonsense.com/2021/10/inflation-vs-stock-market-returns/

(4) https://www.federalreservehistory.org/essays/great-inflation

(5) https://inflationdata.com/articles/2012/01/21/inflation-stock-market-correlation/